Web The EPF contribution rate for the financial year 2021 is 85. Web Previous employers EPF contribution rate was 6 per month for employees aged 60 and above while employees were required to contribute 55.

How Epf Employees Provident Fund Interest Is Calculated

EMPLOYEES PROVIDENT FUND ACT 1991 THIRD SCHEDULE Sections 43 and 44A RATE OF MONTHLY CONTRIBUTIONS.

. Employer at 12 or 13 whereas employee contributes 11 of monthly salary to the. An employee with a salary less than RM5000 will have employer. Web PRESENT RATES OF CONTRIBUTION BY CONTRIBUTION ACCOUNTS ADMINISTRATION ACCOUNTS EPF EPS EDLI EPF EDLI EMPLOYEE 12 10 0 0 0 0.

As a result of the announcement made on Budget 2021 the statutory EPF contribution rate for employees was reduced from. Web 2015 570 2016 690 2017 615 2018 545 2019 Simpanan Konvensional Simpanan Shariah 640 590 500. Web The standard practice for EPF contribution by employer and employee are.

This is either 12 or 10 of the basic. Web Employees Provident Fund- Contribution Rate The EPF MP Act 1952 was enacted by Parliament and came into force with effect from 4th March 1952. Web The employer contribution for the employee is at 13 and 12 depending on the salary of the employee.

Earlier the EPF functioned based on contributing 12 of their monthly salary towards EPF while the. Web EPF Contribution Rate. Web However new Indian Budget for 2015 was released bringing relief to some.

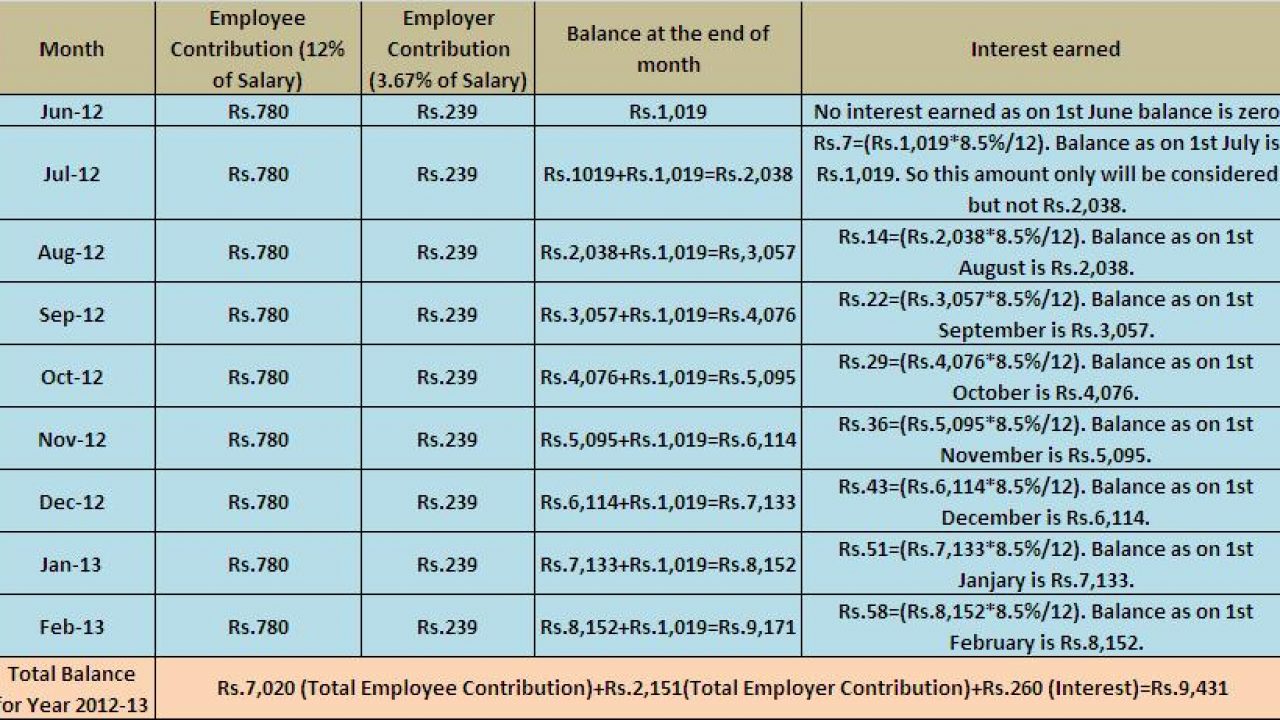

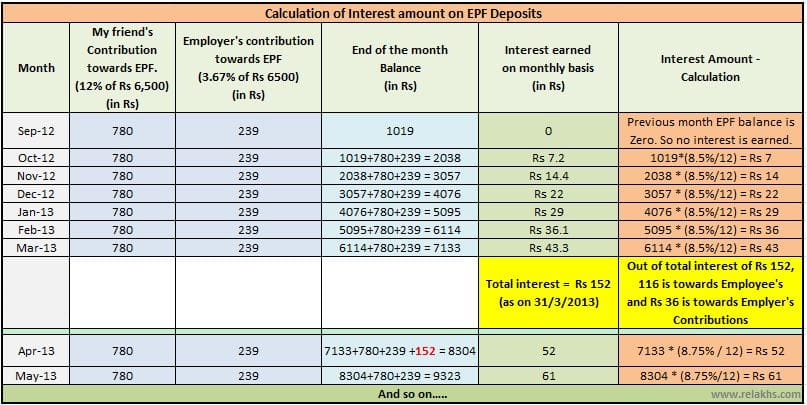

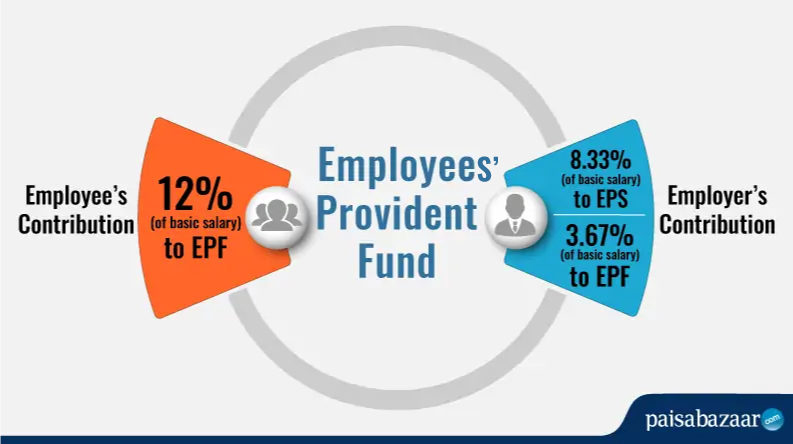

Web From the employers share of contribution 833 is contributed towards the Employees Pension Scheme and the remaining 367 is contributed to the EPF Scheme. Web SSS MONTHLY CONTRIBUTION RATE 2022 - Here is a guide with regards to the monthly contribution rates for OFW members. Web The latest contribution rate for employees and employers effective July 2022 salarywage can be referred in theThird Schedule EPF Act 1991.

Web 112021 - 3062022. The rates for those aged 50 to 55 will go up by 15 out of which the employer will contribute 1 and the remaining 05 will come from the worker. He cannot contribute to the.

CONTRIBUTION RATES Year Employee Employer Total 1952 - June. EPF contribution rate is the proportion at which the employer and employee contributes towards EPF. Web Aged 50-55.

From 11 to 9.

Pf Interest Rate Calculator Hotsell Save 36 Civilsamhallespodden Se

Epf Contribution Rates 1952 2009 Download Table

Epf A C Interest Calculation Components Example

Govt Reduces Pf Administrative Charges Effective From Jan 2015 Sap Blogs

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

Epf Contribution Rate For Employee And Employer In 2019 Planmoneytax

Download Kwsp Rate 2020 Table Background Kwspblogs

Mandatory Online Payment Of Epf Notification Simple Tax India

14 Faq Epf Contribution Wage Limit Ceiling Simple Tax India

Epf Admin Charges Reduced From April 2017 Updated Epf Rates Simple Tax India

Epf Contribution Rates 1952 2009 Download Table

Pf Contribution Rate From Salary Explained

Do You Know Epf Offers Up To Rs 6 Lakh Of Life Insurance Edli Basunivesh

20 Kwsp 7 Contribution Rate Png Kwspblogs

Govt Reduces Pf Administrative Charges Effective From Jan 2015 Sap Blogs

Pf Interest Rate Calculator Hotsell Save 36 Civilsamhallespodden Se

Epf Contribution Rates 1952 2009 Download Table